Diverging Paths: 4 Surprising Trends Redefining the Denver Real Estate Market

Headlines about the real estate market can often feel contradictory and confusing, painting a picture of constant, unpredictable change. For anyone trying to buy, sell, or simply understand the value of their home, cutting through the noise to find clear, actionable information is a major challenge.

The truth is often found by looking past the high-level numbers and digging into the specific trends shaping local behavior.

While the median home price of $589,900 shows relative stability year-over-year, this top-line number masks four profound shifts happening just beneath the surface.

By analyzing the latest housing data from the Denver Metro area for September 2025, we can identify the most surprising and impactful trends that are quietly rewriting the rules of the market.

From a growing split between property types to a new playbook for sellers, these insights into the Denver real estate market trends provide the clarity needed to navigate Denver’s new real estate landscape.

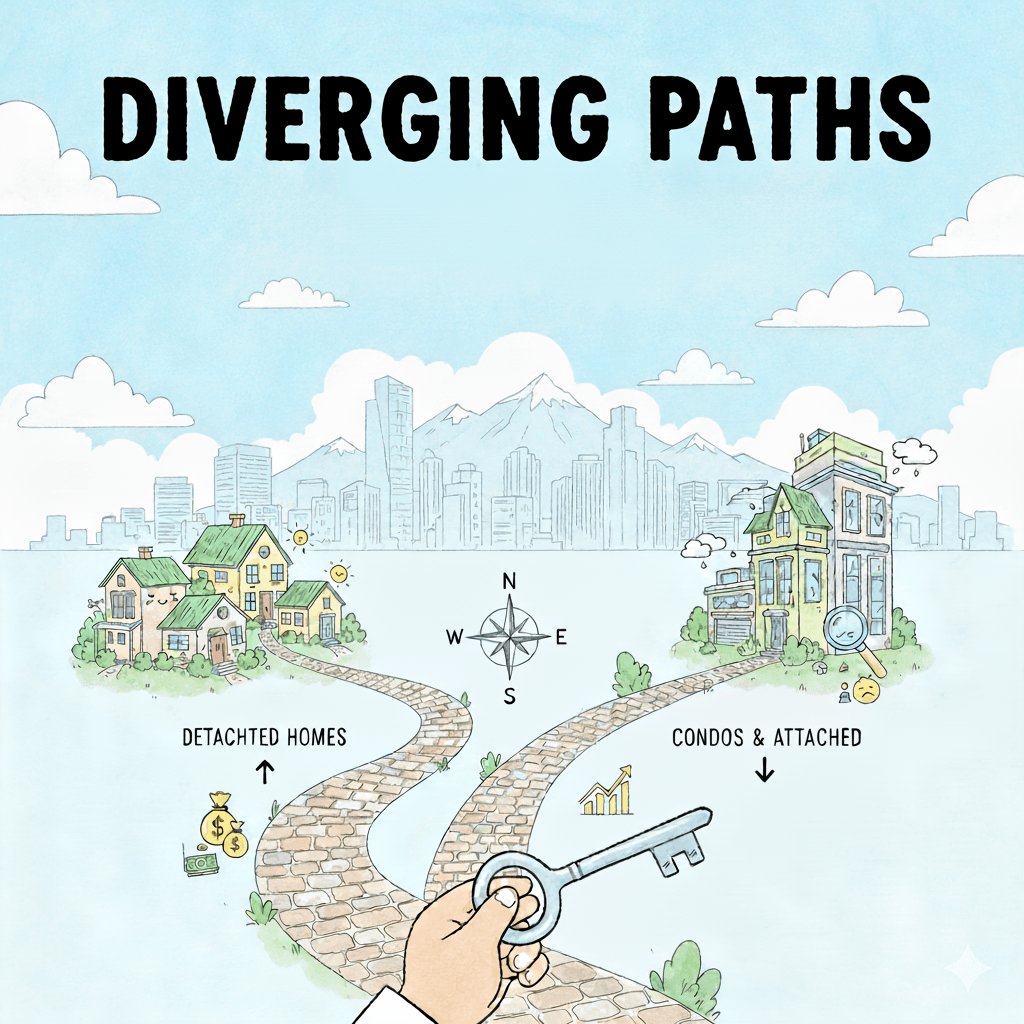

1. The Great Divide: Why Detached Houses and Condos Are on Opposite Paths

A significant performance split is emerging between detached single-family homes and attached properties like condos and townhomes, sending them in opposite directions. While one segment is showing resilience and growth, the other is facing considerable headwinds, creating two very different market experiences under the same “Denver” umbrella.

The data from September clearly illustrates this divergence. When comparing year-over-year performance:

- Sales volume for detached homes was up 6.55%.

- Sales volume for attached homes was down 16.78%.

- The median sale price for detached homes increased by 1.33%.

- The median sale price for attached homes decreased by 3.35%.

The trend can be traced back to a single, very unfortunate event in 2021 – the Surfside Condo Collapse in Miami – that sadly took the lives of 98 people. After this event, insurance companies started looking into Master HOA Policies and the buildings that these policies insure.

What they found was, HOAs across the country have overwhelmingly allowed buildings to fall into disrepair by failing to adequately maintain their properties – usually at the behest of community members voting against maintenance projects that would increase their monthly dues or cause special assessments to be issued.

For many properties, this behavior had gone on for decades and the amount of deferred maintenance to buildings in Condo and Townhome communities was impossible for insurance companies to determine.

Rather than spend the time and effort to determine whether every one of their community policy holders had properly maintained their buildings over the years – the insurance industry did what the insurance loves doing most and increased premium costs across the board. Often to the tune of 400%-800% or more!

These costs were of course absorbed by owners through higher HOA dues, forcing HOAs to find ways to bring these costs down.

In a lot of cases, that process opened up the can of worms that was decades worth of deferred maintenance, often leading to large special assessments or the need for massive loans to address major projects.

So…with all of this happening at the same time as rapid inflation and increased mortgage rates – the monthly costs behind owning a condo or townhome just don’t make sense for your average buyer.

My opinion: despite recent challenges, condos and townhomes reign supreme for entry level housing and can even be an incredible opportunity for those looking to downsize and reduce the maintenance burdens that come with owning a single family home.

In short – don’t sleep on this market segment! Schedule a no-obligation strategy session with me today, and let’s see if taking advantage of some of the amazing deals out there are a good fit for you!

2. The Seller’s Playbook Has Been Completely Rewritten

The strategies that brought sellers overwhelming success during the hyper-competitive 2020-2022 market are now obsolete. A distinct power shift has occurred, giving buyers more leverage and forcing sellers to adapt to a completely new set of expectations. Simply listing a home and waiting for multiple over-asking offers is no longer a viable approach.

Based on insights from local real estate professionals, here are the new rules for sellers in the current market:

- Pricing: Sellers must price their homes against current competition and pending listings, not based on sales data from the past six months. This forward-looking approach is critical for attracting serious buyers.

- Inspections: Inspection waivers are a “thing of the past.” To avoid last-minute negotiations or deals falling through, savvy sellers are now conducting pre-listing inspections and addressing potential issues upfront.

- Concessions: With higher interest rates persisting, requests for rate buydowns from buyers have become common. Sellers should anticipate these concessions as a potential cost and factor them into their pricing strategy before listing.

This recalibrated market demands a more thoughtful and strategic approach from all parties. As Amanda Snitker, Chair of the DMAR Market Trends Committee and Denver Realtor®, notes:

The subtle adjustments show a nuanced buyer and a nuanced seller, requiring tenacity, trust and expertise to make the perfect match.

3. Denver’s Surprising Mortgage Debt: Bucking a Major National Trend

A striking national trend has seen a record-high 40.3% of all homes in the U.S. being owned outright, with no mortgage debt.

This rise in free-and-clear ownership suggests a significant portion of the country’s homeowners are insulated from the pressures of fluctuating interest rates.

Denver, however, stands in sharp contrast to this national movement.

The metro area has one of the lowest shares of mortgage-free homeowners in the country, at just 27.1%. In fact, with one of the highest shares of homes carrying mortgage debt, Denver is second only to Washington, D.C., making it one of the nation’s most extreme examples.

The local implication of this data is significant. With such a high proportion of homeowners carrying mortgage debt, the Denver market could be particularly responsive to future changes in interest rates.

A potential decline in rates could “unlock” a larger pool of buyers than in other cities, as many residents are likely waiting on the sidelines for borrowing costs to become more favorable.

4. An Extreme Buyer’s Market in an Unlikely Place

While the overall market is shifting toward buyers, one specific segment is experiencing this trend in its most extreme form: luxury attached homes.

This niche is currently flooded with inventory, creating an unprecedented opportunity for well-positioned buyers.

The most dramatic statistic is found in the highest end of the market, where there is a whopping 30 months of inventory for attached homes priced over $2 million. That means if no new homes come on the market – it would take 30 months (!!!) for all existing inventory to sell.

The segment just below, from $1.5 million to $1.999 million, also shows a massive oversupply with 20.5 months of inventory.

To put this in perspective, a balanced market is defined as having four to six months of supply. While the detached luxury market has tipped slightly in favor of buyers with 6.03 to 6.98 months of inventory, the attached luxury market has fallen off a cliff into an extreme buyer’s paradise.

For buyers with the means to enter this specific niche, the negotiating power is immense. As the DMAR report’s luxury market analysis concludes:

Now is the time for buyers in this market to land a great deal!

Your Path Forward in Denver’s New Market

Success in Denver’s new real estate landscape is no longer about trying to time the market; it’s about understanding its many micro-climates. The old playbook has been discarded, and navigating this new environment requires expert guidance.

For Sellers: The market has changed, but opportunities are still abundant with the right strategy. The “list it and leave it” days are over. Let’s connect to build a forward-looking pricing strategy, prepare your home to stand out, and expertly navigate inspection and concession negotiations to ensure you achieve the highest possible return.

For Buyers: This is a market of diverging paths, and that means pockets of incredible opportunity are opening up. Whether you’re looking for a resilient detached home or have the means to capitalize on the unprecedented buyer’s market in luxury condos, I can help you find the right property and negotiate from a position of strength.

For Investors: The current trends signal significant future potential. The price correction in the attached market could present a valuable entry point, while Denver’s high proportion of mortgage holders suggests a surge in demand when interest rates eventually fall. Let’s discuss a long-term strategy to leverage these unique market dynamics for your portfolio.