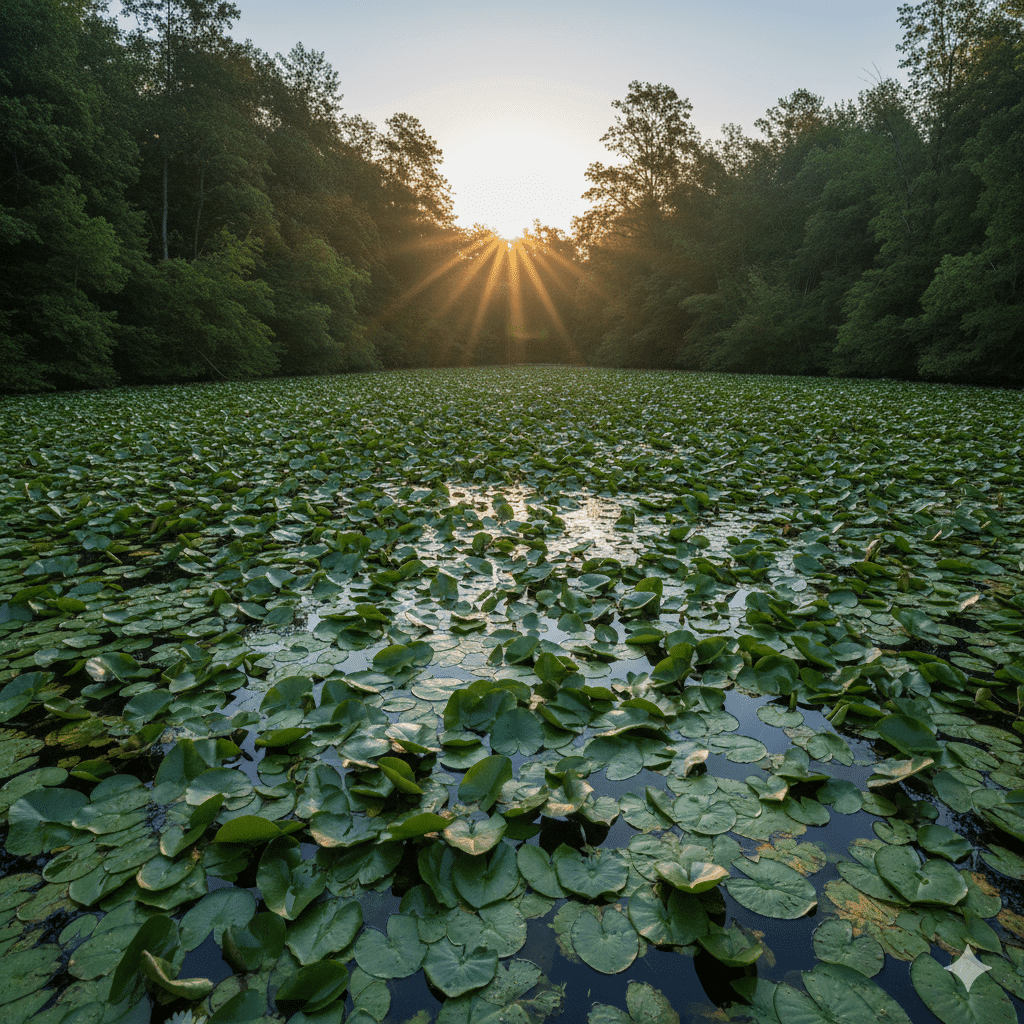

My Father’s Letter “The Lilly Pond” and What It Teaches Us About Investing in Today’s Market

Every now and then I like to browse my father’s old files to find inspiration – his 50+ years in the business made him quite the guru when it comes to Denver real estate investing.

Recently, I found a letter he wrote as the market was recovering from the 2008 downturn. Many of you will remember Van, and some of you were the original recipients of this letter many years ago.

It started with a simple, powerful analogy he called “The Lilly Pond.”

He asked clients to imagine a pond where the number of lily pads doubled every week.

- Week 1: It’s 1% covered. You wouldn’t even notice it.

- Week 2: It’s 2% covered. Still, no big deal.

- Weeks 3 & 4: 4% and 8%. You might think, “It’s still a great place to fish.”

- Week 5: It’s 25% covered. You’d definitely notice the change.

- Week 7: The pond is 100% covered, “completely overwhelmed,” and no longer a good place to fish.

His point was simple: market change is exponential. It seems to happen slowly, and then all at once.

A Timeless Lesson for the Denver Housing Market

Back then, he pointed out that the Denver market took about 6 months to shift from balanced to a seller’s market, but only two more months to become “completely and overwhelmingly over heated.”

That letter and its lesson provide a powerful message for times like the present. It’s the perfect reminder that history has a tendency to repeat itself, to never get complacent, and to respect the speed at which things can change.

Today’s “Lilly Pads”: What Denver Real Estate Market Trends Show Us

We’re in a very different environment than the post-2008 recovery. To the average person, the market looks slow. But the principle of exponential change holds true. Today, I’m not just watching prices. I’m watching the underlying currents – the key indicators for anyone buying investment property in Denver.

- The “Calm Pond” (Inventory): The “pond” of available homes is finally full. Active listings are up over 35% year-over-year, and homes are sitting on the market for 30-45 days. This has given buyers the first real breathing room and negotiating power they’ve had in years. This is the “it’s still a great place to fish” moment.

- The First “Lilly Pads” (Buyer Demand): While the pond looks calm, the lily pads are already growing. Pending sales are up 6% year-over-year. Buyers are quietly and steadily absorbing this new inventory. This is the 2% -> 4% growth that most people are missing.

- The Future Growth (The Rental Squeeze): The multi-family rental market is seeing a temporary softness, which has some investors on the sidelines. Why? A short-term surge of new apartment buildings. But the real story is that new construction starts have fallen off a cliff. This is creating a predictable future inventory shortage, which will lead to a new cycle of aggressive rent growth.

Just like in my father’s analogy, the market feels “stagnant” until, suddenly, it isn’t. The difference between “Week 4” (a balanced market with great options) and “Week 7” (a supply-starved, overheated market) can be a matter of months, not years.

This is the moment to be “plugged in.”

Are You Positioned for the Next Phase of the Market for Denver Real Estate Investing?

My father ended his letter by asking his clients two questions, which I’ll ask you today:

- Are you plugged into this market as well as you’d like to be?

- Are you positioned to take advantage of where the market is headed next?

The tools of the trade have certainly changed since this letter was first mailed. We have more data, faster analytics, and a global reach. But the foundation of this business – providing sound, proactive Denver real estate investing advice – has not.

If you are curious about what today’s “Lilly Pads” mean for the value of your property, or if you’d just like to review your real estate strategy, my line is always open.Just as Van offered, there’s never any cost or obligation until you decide to hire me AND I get the job done for you. Let’s talk.