Denver Real Estate Market Forecast 2026: Trends & Strategy

Table of Contents

- 2025 Market Recap: A Year of Stabilization

- Denver Real Estate Market Forecast 2026

- Key Economic Forces Shaping the Market

- Strategic Advice for Buyers and Sellers

- Local Developments to Watch

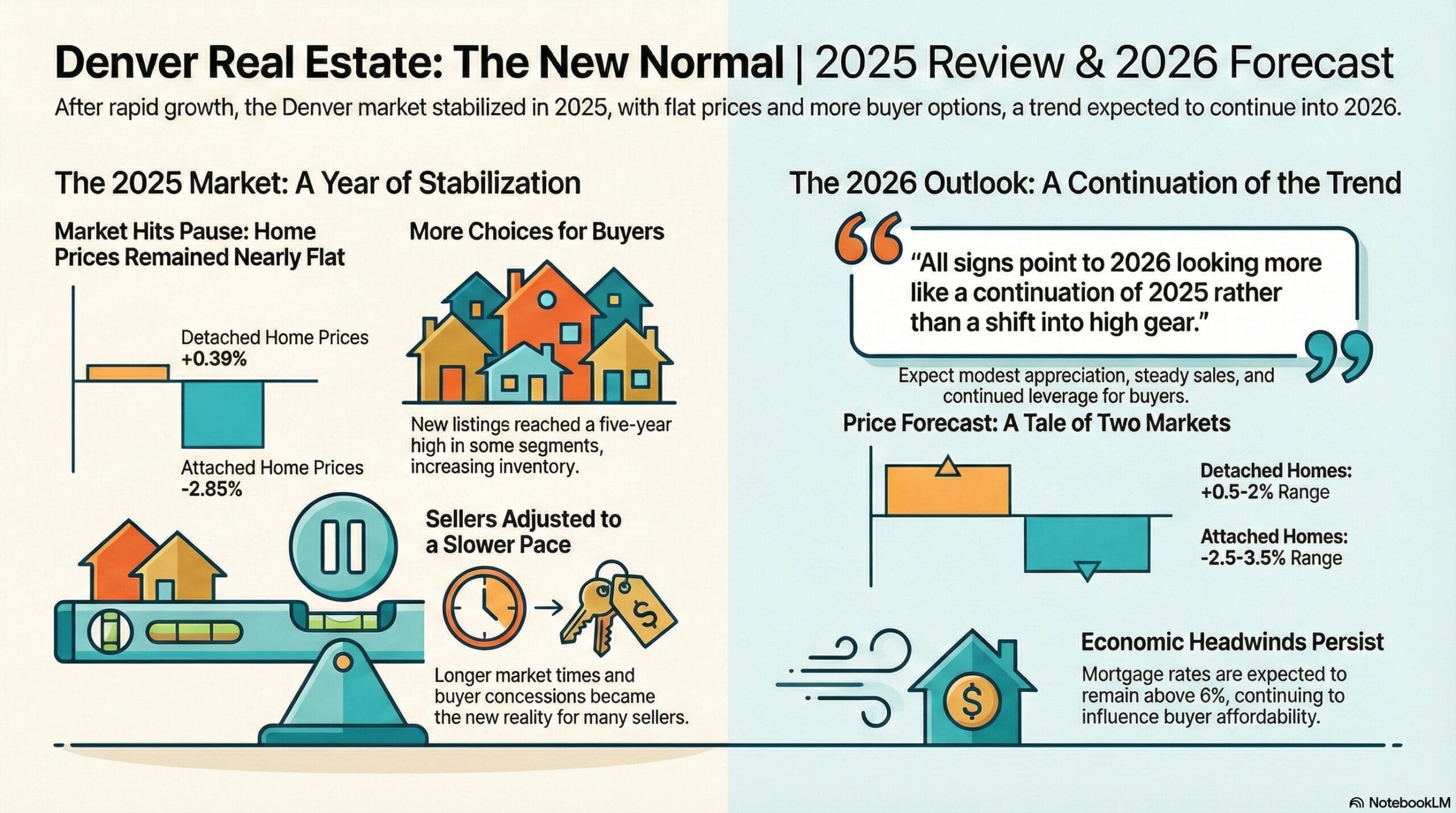

Are you wondering where the Denver real estate market is heading in 2026? After a year defined by stabilization, the Denver Metro area is shifting away from rapid post-pandemic appreciation toward a more balanced environment.

In 2025, market psychology was shaped by external economic forces – from persistent inflation to Federal Reserve policies – which anchored mortgage rates in the 6% to 7% range. As we move into 2026, understanding these trends is critical for anyone looking to buy or sell in Colorado.

2025 Market Recap: A Year of Stabilization

The Denver Metro real estate market in 2025 solidified its transition into a period of stabilization. Moving beyond the volatile appreciation seen from 2020 to 2022, the industry adapted to a “new normal.”

According to Amanda Snitker, Chair of the DMAR Market Trends Committee, “2025 reflected an industry adapting to a more balanced environment where both buyers and sellers had to adjust their footing.”

Key Performance Indicators

Market performance largely remained flat year-over-year. The median sale price for detached homes saw a negligible increase of 0.39%, while attached homes experienced a 2.85% decrease.

While inventory increased—giving buyers more options—total sales volume and closed transactions remained static for the third consecutive year.

December 2025 vs. 2024 Year-to-Date Metrics:

Metric (Residential) | YTD Dec. 2025 | YTD Dec. 2024 | % Change |

|---|---|---|---|

Active Listings at Month’s End | 7,607 | 6,888 | +10.44% |

New Listings | 59,671 | 55,866 | +6.81% |

Closed Sales | 42,268 | 42,617 | -0.82% |

Median Close Price | $593,000 | $590,000 | +0.51% |

Average Close Price | $708,725 | $699,867 | +1.27% |

Sales Volume | $29,956,373,434 | $29,826,233,299 | +0.44% |

Median Days in MLS | 25 | 18 | +38.89% |

Average Days in MLS | 47 | 38 | +23.68% |

Sellers faced longer days on market and often provided concessions or rate buy-downs to close deals. Meanwhile, a “holiday slowdown” in December 2025 saw active listings drop by nearly 28%, setting the stage for a busy first quarter in 2026.

Denver Real Estate Market Forecast 2026

The outlook for 2026 suggests a continuation of stability rather than dramatic swings. Success will depend less on timing the market and more on strategic execution.

Price and Sales Projections

Key Economic Forces Shaping the Market

Real estate in Denver has become “collateral damage” from wider economic forces. Understanding these macro trends is essential for interpreting the Denver real estate market forecast 2026.

Mortgage Rates and Inflation

Federal Reserve policy, influenced by tariff uncertainties and inflation (sticking around 3%), has kept mortgage rates elevated. According to Chris Flanders of Commerce Bank, the longer end of the yield curve remains focused on the government’s fiscal condition.

Most housing economists expect mortgage rates to remain above 6% throughout 2026, despite recent Fed cuts.

Colorado Economy vs. National Trends

The local economy offers a slightly brighter picture than the national average. The University of Colorado Leeds School of Business projects:

However, challenges remain. Insurance costs for Colorado homeowners have climbed roughly 137% over the past decade due to wildfire and hail risks, significantly reducing buyer purchasing power.

Strategic Advice for Buyers and Sellers

With the market rewarding preparation over speculation, here is how you can navigate the landscape.

For Buyers

For Sellers

Local Developments to Watch

Despite a stabilizing market, Denver continues to see significant investment.

The Denver real estate market forecast 2026 points to a balanced, stable year. While price appreciation will be modest for single-family homes, the challenges in the attached home market and persistent insurance costs require careful navigation. Whether you are buying or selling, realistic expectations and creative financing will be your best tools for success.

Don’t Just Watch the Market—Master It.

The 2026 Denver market is defined by stability, but success requires strategy. Whether you are worried about rising HOA fees or looking to capitalize on the Q1 inventory bump, you need a plan tailored to your goals.