Denver Real Estate Market Briefing: February 2026

Key Details

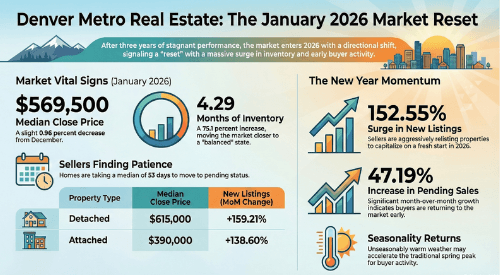

The Denver Metro residential real estate market entered 2026 following a three-year period of stagnant, “sideways” performance characterized by high affordability pressures and buyer/seller fatigue. January 2026 data reveals a market attempting to break this cycle, marked by a massive 152.55% month-over-month surge in new listings as sellers, many of whom withdrew listings in late 2025, returned to the market.

While inventory is rising—now sitting at 4.29 months—sales activity remains historically low. With only 1,919 closed sales in January, the market is seeing activity levels reminiscent of the post-financial crisis years of 2010 and 2011. Despite the low closing volume, a 47.19% increase in pending sales suggests a seasonal uptick is underway. Prices remain relatively flat to slightly declining, with the median close price for residential properties sitting at $569,500. Buyers currently benefit from increased options and a “renter-friendly” apartment market, though high interest rates and land costs continue to challenge overall affordability.

Market Performance Overview

The following table summarizes the key residential statistics for the Denver Metro area as of January 2026, comparing performance to the previous month and the previous year.

Key Residential Statistics (January 2026)

| Metric | January 2026 | MoM Change | YoY Change |

| Median Close Price | $569,500 | -0.96% | -0.96% |

| Average Close Price | $676,548 | -0.02% | -1.39% |

| Closed Homes | 1,919 | -40.55% | -19.74% |

| New Listings | 4,455 | +152.55% | +2.41% |

| Active Listings | 8,228 | +8.16% | +7.02% |

| Pending Sales | 3,060 | +47.19% | +8.47% |

| Months of Inventory | 4.29 | +75.10% | — |

| Median Days in MLS | 53 | +17.78% | +17.78% |

| Sales Volume | $1.30 Billion | -40.56% | -20.85% |

Segment Analysis: Detached vs. Attached

• Detached Homes: The median close price for detached homes fell to $615,000, a 1.60% decrease from December and a 3.61% drop year-over-year. This segment saw a significant 159.21% increase in new listings month-over-month, though actual closings were down 40.75%.

• Attached Homes: This segment showed more price resilience, with the median close price increasing 1.30% month-over-month to $390,000, although this remains 2.01% lower than January 2025. Attached properties stay on the market longer, with a median of 63 days in MLS compared to 50 days for detached homes.

Inventory and Buyer Activity Trends

The Surge in Listings

The 152.55% month-over-month increase in new listings is unseasonably high compared to the historical average decline of 3.28% from December to January. This influx is largely attributed to “seller fatigue” from late 2025, where homeowners withdrew properties with the intention of relisting for a “fresh start” in the new year.

Market Balance and Stagnation

• Months of Inventory (MOI): At 4.29 months, the market is entering a “balanced” state (typically defined as four to six months). This is a stark contrast to the record low of 1,184 listings in January 2022.

• Days on Market: Properties are taking longer to sell. The average days in MLS reached 74, a 23.33% increase year-over-year. Sellers are reportedly adjusting to these longer periods without panic, recognizing the shift in the environment.

• Close-to-List Ratio: The average ratio fell to 97.94%, indicating that sellers are increasingly willing to negotiate as properties sit longer.

Economic and Regulatory Influences

Local Colorado Trends

• Outbound Migration: Colorado now ranks fifth nationally for outbound moves, with 55% of moves leaving the state.

• Land Costs: Residential land value in Colorado reached an average of $942,200 per acre in 2022, a 174% increase since 2012, ranking among the fastest gains in the U.S.

• Environmental Regulations: New state laws require gas furnaces and water heaters manufactured after January 1, 2026, to meet Ultra Low NOx or ENERGY STAR® standards. These replacements are expected to cost 40% to 200% more than previous systems.

• Administrative Changes: Denver has ceased mailing physical property tax bills, moving to online statements to save approximately $100,000 and 500,000 pieces of paper annually.

National Factors

• Institutional Investors: A proposal by President Trump to ban large institutional investors from purchasing single-family homes aims to reduce competition for individual buyers. However, experts suggest the real-world impact may be modest due to the small market share these investors hold.

• Monetary Policy: Kevin Warsh has been nominated as the next Federal Reserve chair. Known for supporting lower interest rates, his leadership could influence future mortgage affordability.

• Mortgage Delinquencies: Late-stage mortgage delinquencies hit a three-year high in December 2025.

Rental Market and Alternative Housing

Multi-Family Dynamics

Metro Denver’s apartment market is currently “renter-friendly” with a 7.6% vacancy rate, the highest in 16 years. A decade-long supply surge has outpaced demand, leading to:

• Lower average rents (Multi-family median rent: $1,445, down 3% YoY).

• Increased concessions for new renters.

• A projected sharp slowdown in construction for 2026 due to financing challenges and permitting delays.

Single-Family Rentals

The median single-family rent in January was $2,720, a 2% decrease year-over-year. Available single-family rental listings have fallen for six consecutive months.

Strategic Outlook and Expert Recommendations

For Sellers

• Realistic Pricing: Success in the current “sideways” market requires pricing based on both statistical data and qualitative market factors.

• Preparation: High-quality presentation is mandatory. Experts note that “cell phone photos and cluttered spaces no longer cut it.”

• Incentives: Offering seller concessions is an aggressive but effective strategy. In 2025, over half of closed mortgage transactions in Denver included seller concessions to help buyers with closing costs.

For Buyers

• Affordability Gains: While Denver remains expensive, income growth is beginning to outpace home price gains nationally.

• New Construction Opportunity: New-home prices have converged with, or fallen below, existing-home prices in some cases. Builder price cuts and incentives may provide a “rare window of opportunity” in 2026.

• Seasonal Advantage: An unseasonably warm winter may accelerate the traditional spring market. Well-priced and well-maintained homes in top-tier locations are still expected to trigger bidding wars.

Mortgage Strategies

Buyers are encouraged to evaluate three primary financial tools to manage high costs:

1. Lender Credits: Accepting a higher interest rate in exchange for the lender covering closing costs.

2. Permanent Point Buy-Downs: Paying upfront fees to lower the interest rate for the life of the loan.

3. Seller Concessions: Negotiating for the seller to cover closing costs (subject to loan program limits).

Ready to navigate the new Denver market? Whether you are looking to leverage your buyer power or need a data-driven strategy to sell your home in a balanced market, we are here to help.