The Denver Real Estate Review | November 2025

At a Glance: October 2025 Market Key Takeaways

Normalization, Not Crash: The market has settled into a sustainable rhythm. Since 2020, price growth has averaged 6.74%, aligning perfectly with historical norms.

Buyers Regain Leverage: With inventory up 14.21% year-over-year, buyers now have the power to negotiate inspections and price—frenzy is out, due diligence is in.

Luxury Defies Seasonality: While the mid-tier market ($500k-$750k) stalls due to affordability, the Luxury market ($1M+) saw a surprising 17% surge in sales volume.

Mortgage Context: Current rates (~6.25%) remain well below the 50-year historical average of 7.7%, despite feeling high compared to the “unicorn years” of 2020-2022.

Boots on the Ground

As we get deeper into Fall and take a look back at the Denver housing market this year, it’s clear that housing is in a state of recalibration. This environment is not a crash – though I’m sure it felt like it for plenty of sellers this year. Instead, it represents a shift towards a more balanced and sustainable ecosystem where realism and strategy are more important than ever.

The Big Picture: Normalization vs. Crash

The best way to understand what’s happening is to zoom out and look at home prices from a long-term perspective.

Between March 2020 and the peak in April 2022, prices grew at an average annual rate of 19.25%. From March 2020 through October 2025, that average has settled to a more sustainable 6.74%.

If you go even wider and look at historical averages, median home price growth for the metro area tends to run at about 6%. This rebalance positions the median sale price firmly within the historical trend range. Once you understand that; it’s easy to see, the market is simply normalizing.

Mortgage Rates: A Historical Perspective

That also tracks when you look at mortgage rates from the same long-term perspective. Only for 30-year mortgages, the historical average (1971-2025) is around 7.7%, well above current rates which have been hovering around 6.25%.

When you zoom out on that chart, it’s pretty striking that the only time mortgage rates have dipped below 6% was the period between 2009-2022. We all know what happened in 2009, but this leads to a lesser known point that I made a few months back.

The Impact of Conservatorship: When the government had to bail out Fannie Mae and Freddie Mac, they put them into conservatorship. Those mortgage-backed securities (MBS) became much less risky to investors because the government protected them from losses.

They did this to keep mortgage rates in check, since one of the primary factors (there are many) that determine mortgage rates is the supply/demand curve for MBS. To make extra sure mortgage rates didn’t continue to spiral, the Fed started buying MBS for the first time in history. In fact, they became the primary buyer for MBS, buying up ~40% of the market until…well…until April of 2022.

Understanding the “big picture” is the first step. The next is applying that knowledge to your personal goals. In a balanced market, strategy, data, and ‘boots on the ground’ expertise matter more than ever.

Thinking of Selling?

Let’s use real-time data to price and position your home to win.

Thinking of Buying?

The frenzy is over. Let’s find your home with a clear head and a strong negotiating strategy.

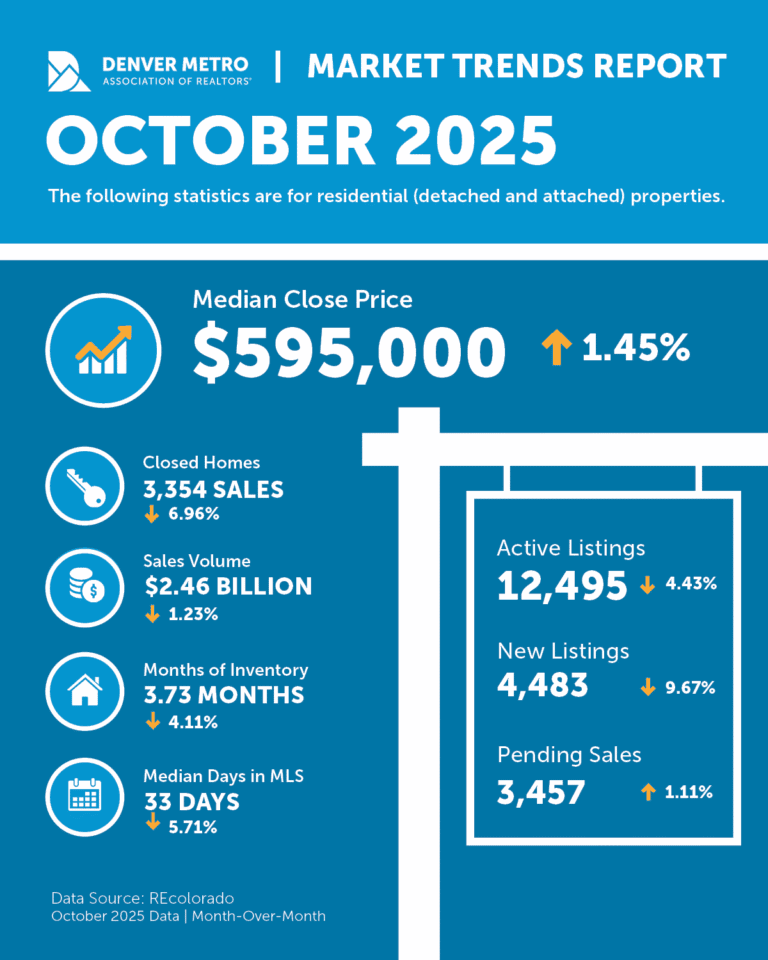

DMAR Market Trends Report (October 2025)

Key Denver Housing Trends and Statistics (October 2025)

The October data illustrates a market where inventory is growing year-over-year even as new listings slow, indicating that buyer demand has not kept pace with the accumulation of supply. However, sales activity remains resilient, nearly matching 2024 levels.

Metric | October 2025 Status | Key Details |

|---|---|---|

End-of-Month Inventory | ▲ Increased 14.21% | Year-over-year increase. |

New Listings (Monthly) | ▼ Decreased 4.60% | Compared to October 2024. |

New Listings (YTD) | ▲ Increased 7.87% | Year-over-year increase. |

Homes Sold (YTD) | ▼ Decreased 0.42% | Total of 36,053 homes sold, just 152 fewer than YTD 2024. |

Median Days in MLS | 31 (Detached) / 41 (Attached) | Detached homes spent slightly less time on the market month-over-month. |

Sale-to-List Price Ratio | 98% | Both attached and detached homes sold close to their asking price. |

Median Sale Price (Detached) | ▬ Flat | No change year-over-year. |

Median Sale Price (Attached) | ▼ Decreased 2.95% | Year-over-year decrease. |

Denver Housing Analysis by Price Bracket

Here’s a quick breakdown of what’s happening in in different price brackets. Homes priced over $1 million have remained relatively sought after – while price bracket struggling the most has been the $500,000 – $750,000 price bracket.

Luxury Market ($1 Million+)

Contrary to seasonal expectations, the luxury market experienced a significant surge in activity in October, with one expert noting “the fog is beginning to lift.”

- Increased Sales: Month-over-month sales rose substantially for both detached homes (+17.46%) and attached properties (+14.29%).

- High-Profile Closings: The market was bolstered by a $10.13 million condo sale in Cherry Creek North and an $8.15 million home sale in Cherry Hills Village.

- Strong Demand: Months of inventory decreased as buyer demand outpaced the available supply of homes.

- October Statistics: The average closed price was $1,683,257.41, with 495 closings generating a total sales volume of $833,212,420.

Upper Tier Market ($750k – $999k)

This segment is defined by stability and consistency, with demand holding steady over the past three years.

- Stable Sales: Year-to-date sales in 2025 (5,733) are consistent with 2024 (5,688) and 2023 (5,325).

- Flat Values: Price per square foot remains consistent at $282, compared to $285 in 2024.

- Slower Pace: The market has a slower rhythm, with half of all homes taking more than 35 days to sell and an average of 53 days on the market.

- Attached Home Weakness: The attached market, making up only 8% of this segment, shows a notable decline, with the price per square foot down 15.58% year-over-year.

Mid-Tier Market ($500,000 – $749,999)

This price bracket is the most impacted by ongoing economic disruption and affordability constraints.

- Stalled Activity: Median days on the market stalled at 33, unchanged from the previous month.

- Price Decline: This segment saw the largest price per square foot drop of any bracket in October, falling 3.60% year-over-year.

- Buyer Hesitation: Persistent economic uncertainty and rising costs are causing a large number of potential homebuyers in this range to delay their purchasing decisions.

Denver Housing Analysis by Market Segment

Buyer Behavior and Psychology

Today’s buyers are operating with a different mindset. An unusual surge in late-fall activity suggests they are strategically re-entering the market. However, they are far more discerning and cautious than in previous years.

- Increased Scrutiny: Lenders and title representatives report a rise in buyer terminations during the inspection phase, often for issues that are not considered major. This highlights that “today’s buyers are not only price-sensitive but also inspection-sensitive.”

- Negotiation Power: With less competition, buyers have regained leverage, allowing for more thorough inspections and the ability to make offers based on long-term value rather than a fear of missing out.

- Affordability Hurdles: Buyers in the mid-tier market are “checking out” due to compounding financial pressures, including surging home insurance premiums, rising utility costs, and price volatility from tariffs.

Seller Conditions and Strategy

Sellers must adapt to a more competitive and demanding market. Holding firm on outdated pricing or failing to prepare a home is resulting in fewer showings and a lack of offers.

- Heightened Competition: Sellers are not just competing with their neighbors. They are also up against a 20% increase in new construction sales (as of August) and rental properties offering significant incentives, such as 12 weeks of free rent.

- Strategic Pricing: Realtors® advise that sellers who price aggressively and prepare their homes properly are achieving quick sales.

- Focus on Value, Not ROI: Basic home maintenance like replacing a roof or HVAC system helps a home remain desirable but does not guarantee a return on investment. To stand out, sellers are advised to invest in energy efficiency upgrades, take steps to reduce home insurance premiums (e.g., fire hardening), and be prepared to offer rate buydown incentives.

Denver Rental Market Overview

The rental market shows mixed results as it enters its typical slow season. While overall rents are down from their peak, they remain elevated compared to 2022. The drop is more pronounced when factoring in “effective rent,” which includes landlord concessions.

Rental Type | October Median Rent | Change from Sept. 2025 | Change from Oct. 2924 | Median Days on Market |

|---|---|---|---|---|

Single Family | $2,700 | ▼ Down from $2,778 | ▬ Flat | 25 |

Apartments | $1,558 | ▲ Up from $1,500 | ▲ Up 2% | 30 |

Broader Context: National and Local Influences

National Real Estate Trends

- Long-Term Forecast: Moody’s Analytics projects a decade of stability, with annual home price increases forecast to be between 0.5% and 2.8% from now until 2035.

- Technology: The integration of ChatGPT with Zillow indicates that Realtors® will soon need to optimize property descriptions for AI-driven search.

- Cash Sales: All-cash purchases accounted for 33% of national home sales in the first half of 2025, a rate that remains well above pre-pandemic levels.

- Attached Homes: The national condo market is challenging, with 72% more sellers than buyers as of August due to affordability, complex rules, and a cooling rental market prompting investor pullback.

Local Denver Developments

- Housing Policy: Denver’s recent elimination of parking minimums is projected to boost housing construction by approximately 12.5%, adding an estimated 460 new homes annually.

- Consumer Protection: An Adams County judge ordered MV Realty to remove its controversial “Homeowner Benefit Agreements”—40-year listing contracts that functioned as liens—from public records.

- National Recognition: In the third quarter of 2025, Denver’s 80246 zip code was ranked the third-hottest zip code in the United States by The Business Journals.