Best Places for Denver Real Estate Investment in 2026: Follow the Jackhammers

Key Details

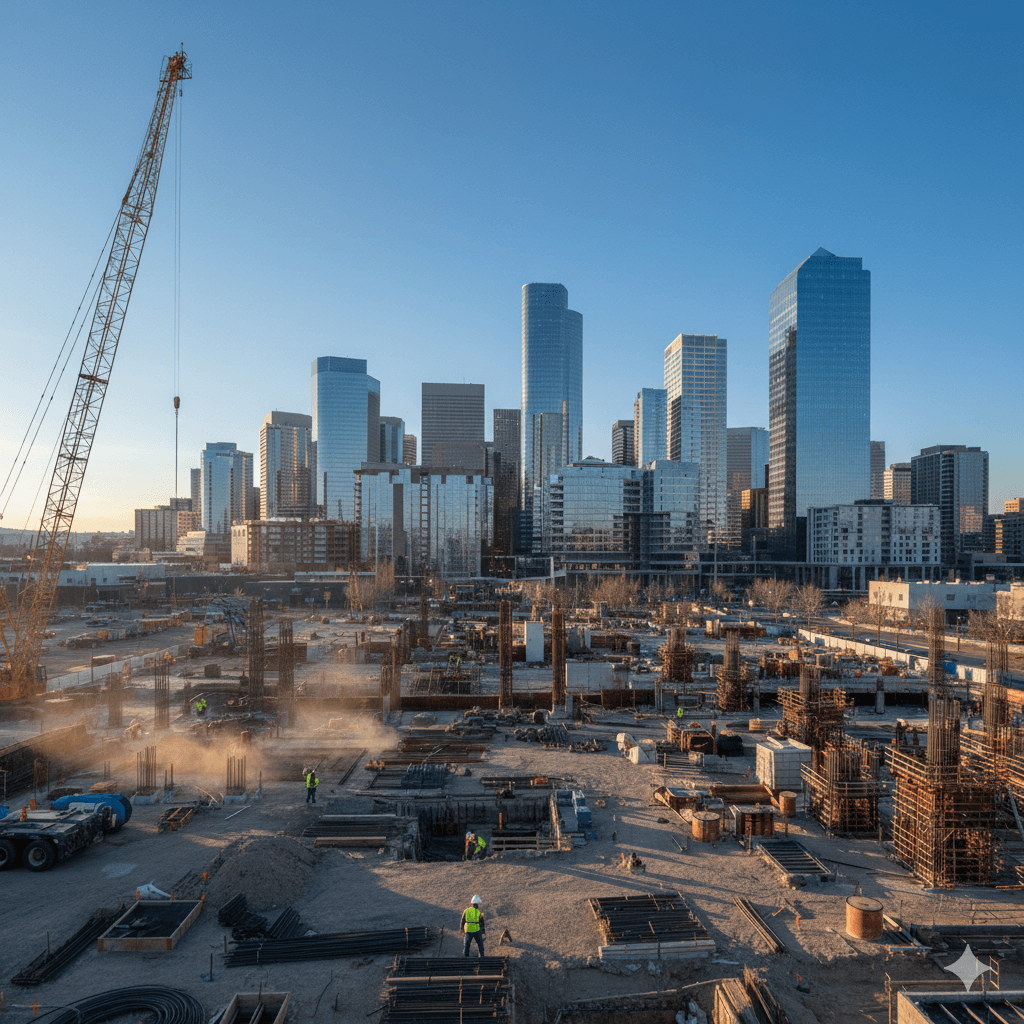

If you want to find value with Denver real estate investment in 2026, don’t look at the finished luxury builds – look at where the road closures are.

Property appreciation usually trails infrastructure projects. The best time to buy isn’t when the ribbon is cut, but when the dust is still in the air. Three major civil engineering projects are currently rewriting Denver’s connectivity, and the construction friction they cause is temporarily suppressing prices. That’s where the opportunity lies.

East Colfax BRT: The “Construction Dip”

The work on East Colfax is the biggest change to the urban core’s transit since the light rail expansion. Right now, it is a pain. From Broadway to I-225, lane closures and diverted traffic are hurting small business foot traffic and increasing vacancy in residential rentals.

This is the classic “construction dip.” Accessibility issues often soften values temporarily. But once the system goes live – projected for late 2027 or 2028 – commute times to Anschutz and Downtown will drop significantly. Buying multi-unit properties in neighborhoods like Hale, Montclair, and Mayfair – especially within a few blocks of the future stations – means buying at a discount before that connectivity bump happens.

The 16th Street Mall: A Case Study in Recovery

The construction walls are finally down. The 16th Street Mall reopening in late 2025 should help to bring pedestrians back to the spine of the city, which is critical for the residential market in LoDo and the Golden Triangle.

The construction blight certainly wasn’t the only thing dragging down condo values nearby (just look at the price reductions on these recent sales), but restoring this critical infrastructure at the heart of the city is a step in the right direction.

The “bleeding” hasn’t stopped, but we’re seeing the start of a slow recovery in CBD condo prices with the city focused heavily on bringing the area back to life. I have a hunch that this will serve as a proof of concept for Denver real estate investment: those who bought during the chaos will be positioned well for a sharp rebound (eventually).

I-70 Floyd Hill: The Mountain Corridor Play

If you’re looking at short-term rentals or secondary homes in the foothills – Genesee, Idaho Springs, Evergreen – the Floyd Hill project is the main factor to watch.

Throughout 2026, the rock blasting and realignment work will cause massive delays. This creates a “time tax” for commuters, making living west of El Rancho less appealing in the short term. However, this bottleneck is the biggest thing choking the corridor. When it is finished in 2029, Idaho Springs becomes a much more viable commuter option. Buying now, while the commute is miserable and prices are soft, sets you up for the jump in value when the traffic actually flows.

Globeville & Washington Street: The Long Game

The Washington Street reconstruction is turning an old industrial trucking route into a proper multi-modal street. It is the necessary first step for the Fox Park redevelopment. While Fox Park is a long-term play (think 10+ years), the infrastructure work happening right now makes Globeville an interesting place to park some capital if you can wait.

Spot the Opportunity Before the Dust Settles. Smart investing is about timing. If you’re ready to identify which Denver neighborhoods are poised for appreciation in 2026, let’s look at the map together.