The Denver Real Estate Review | October 2025

Boots on the Ground

Headlines about Denver real estate insights can feel contradictory and confusing, painting a picture of constant, unpredictable change. For anyone trying to buy, sell, or simply understand the value of their home, cutting through the noise to find clear, actionable information is a major challenge.

The truth is often found by looking past the high-level numbers and digging into the specific trends shaping local behavior.

One trend that’s been growing in prominence – basically since the pandemic times – is the diverging paths between single family homes and attached homes like condos and townhomes. This can be easy to miss when you lump these property types together – but if you look at each individually a new picture emerges.

While one segment is showing resilience and growth, the other is facing considerable headwinds, creating two very different experiences under the same “Market” umbrella.

The data from September clearly illustrates this divergence. When comparing year-over-year performance:

- Sales volume for detached homes was up 6.55%.

- Sales volume for attached homes was down 16.78%.

- The median sale price for detached homes increased by 1.33%.

- The median sale price for attached homes decreased by 3.35%.

The trend can be traced back to a single, very unfortunate event in 2021 – the Surfside Condo Collapse in Miami – that sadly took the lives of 98 people. After this event, insurance companies started looking into Master HOA Policies and the buildings that these policies insure.

What they found was, HOAs across the country have overwhelmingly allowed buildings to fall into disrepair by failing to adequately maintain their properties – usually at the behest of community members voting against maintenance projects that would increase their monthly dues or cause special assessments to be issued.

For many properties, this behavior had gone on for decades and the amount of deferred maintenance to buildings in Condo and Townhome communities was impossible for insurance companies to determine.

Rather than spend the time and effort to determine whether every one of their community policy holders had properly maintained their buildings over the years – the insurance industry did what the insurance loves doing most and increased premium costs across the board. Often to the tune of 400%-800% or more!

These costs were of course absorbed by owners through higher HOA dues, forcing HOAs to find ways to bring these costs down. In a lot of cases, that process opened up the can of worms that was decades worth of deferred maintenance, often leading to large special assessments or the need for massive loans to address major projects.

So…with all of this happening at the same time as rapid inflation and increased mortgage rates – the monthly costs behind owning a condo or townhome just don’t make sense for your average buyer.

My opinion: despite recent challenges, condos and townhomes reign supreme for entry level housing and can even be an incredible opportunity for those looking to downsize and reduce the maintenance burdens that come with owning a single family home.

In short – don’t sleep on this market segment!

Schedule a no-obligation strategy session with me today, and let’s see if taking advantage of some of the amazing deals out there are a good fit for you!

Financing Snapshot

By all accounts – mortgage rates are expected to continue their gradual march lower – but is it too little too late for the market?

With home prices softening a bit, there has been some relief for buyers, but cost living increases and economic uncertainty seem to be holding back a lot of the optimism we saw in the market during this time last year.

Time will tell – but mortgage rates are taking a bit of a back seat in the conversations that I’m having with buyers right now. As helpful as it is to see them go lower – I don’t know whether that will be the catalyst for increased demand going into the fall.

Market Insights

Overall Market Performance: A Steady but Shifting Landscape

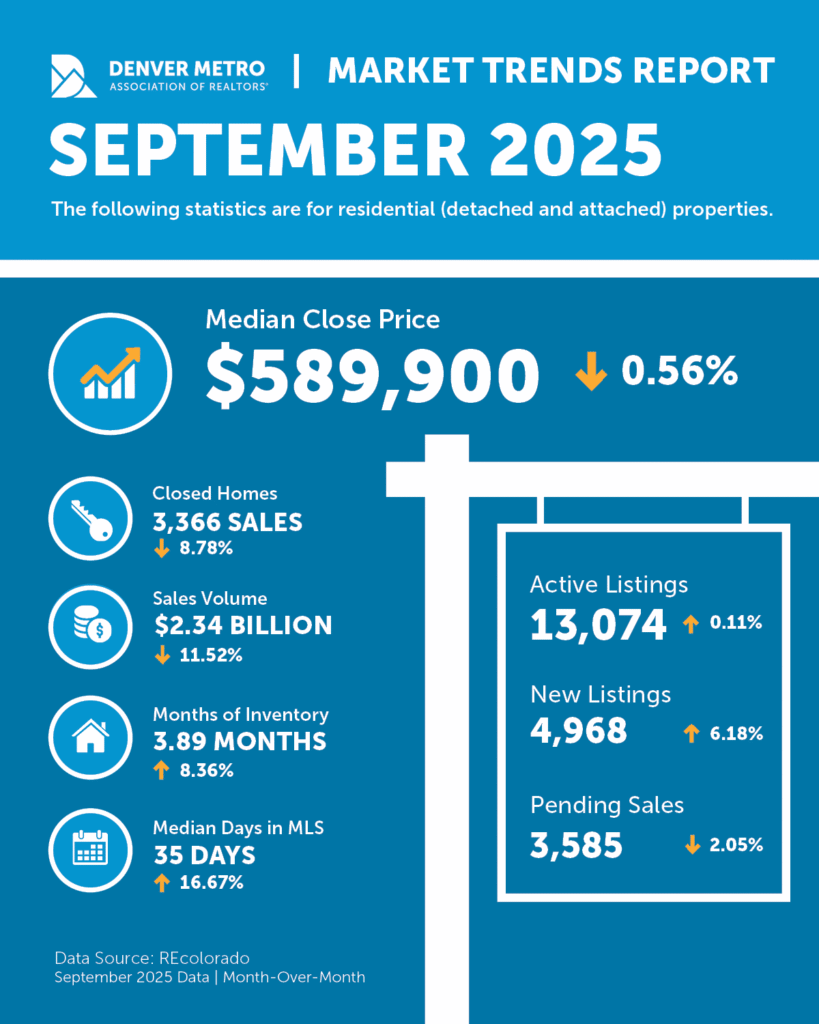

The September 2025 market reflects a period of recalibration.

As noted by Amanda Snitker, Chair of the DMAR Market Trends Committee, “The seasonality and economic conditions of our market today are micro adjustments compared to a market where we see large swings in demand and prices, as we did during 2020 through 2022.” This nuanced environment demands expertise to navigate, as both buyers and sellers adjust to new dynamics.

At this point, the market balance has tilted decisively in favor of buyers.

• Buyer’s Market Confirmed: Denver ranks as a strong buyer’s market, with 57% more sellers than buyers.

• Increased Inventory: Active listings at month’s end (13,074) are up 17.62% year-over-year and a striking 71.37% compared to September 2023. Year-to-date, active listings are up 229.24% from the low point in 2021.

• Longer Market Times: The median time a home spends on the market has increased to 35 days, a 40% jump from the 25 days recorded in September 2024. The average Days in MLS is 53, up 32.50% year-over-year.

• Slightly Lower Sale Prices: The close-price-to-list-price ratio was 98.32%, down from 98.91% a year ago, indicating more room for negotiation.

Dominant Theme: The Primacy of Affordability

Affordability has become the central issue shaping the Denver market. As stated by Realtor Colleen Covell, “Realtors® like to say that the most important consideration in a real estate market is ‘location, location, location.’

In Denver, now this consideration is ‘affordability, affordability, affordability.’” This concern directly contributes to growing inventory, longer selling times, price reductions, and an increase in seller concessions.

• Interest Rate Context: A 25-basis-point reduction in the federal funds rate in September brought mortgage rates to their lowest point in 2025. However, this did not trigger a rush of buyer activity, suggesting buyers remain cautious due to broader concerns about inflation and employment. The average 30-year fixed mortgage rate subsequently reversed its downward trend, increasing to 6.46% in the last week of the month.

• Common Concessions: With persistently higher interest rates, requests for seller-paid rate buydowns have become a common negotiating point.

Denver Real Estate Insights: Evolving Strategies for a New Market Reality

The shift in market dynamics requires both sellers and buyers to adapt their strategies. The fast-paced, seller-dominated tactics of previous years are no longer effective.

Seller Adjustments

• Modern Pricing Strategy: A smart pricing strategy now involves comparing a home against current similar inventory and pending listings, rather than relying on sales data from the past six months.

• Proactive Inspections: Inspection waivers are described as “a thing of the past.” Savvy sellers are now conducting pre-listing inspections to address issues upfront and avoid last-minute negotiations or buyer credits.

• Anticipating Concessions: Sellers should factor potential buyer concessions, particularly for rate buydowns, into their net sheets before listing their property.

• Adapting to New Showing Schedules: With remote work established as a norm, sellers should expect showings to occur throughout the week, not just on weekends.

Buyer Advantages

• Increased Options: A significant year-over-year increase in active listings gives buyers more choices than they have had in years.

• Negotiating Leverage: With homes staying on the market longer and the close-to-list-price ratio declining, buyers have more power to negotiate on price and terms.

• Deliberate Pace: Buyers are moving more deliberately, taking their time to evaluate properties without the intense pressure of the previous market cycle.